Martin Calvert and Chris Mawson at ICS-digital run the rule over gaming market SEO in Japan and discover that the emerging nature of the country’s grey gambling sector brings both chances and risks for affiliates.

Japanese audiences, while known for their passion for online entertainment gaming and gambling nevertheless have been seen as hard to reach by ‘Western’ operators and affiliates.

The regulatory landscape both perceived and real, cultural differences and the scale of SEO challenges have all led to some uncertain marketing strategies. However, as Japan’s gambling sector undergoes new changes, the draw of the market is on the rise.

Understanding the nuances of this evolving landscape, particularly in the context of SEO, has encouraged some operators to make future plans.

This is particularly true for affiliates who have been hit hard by the March 2024 Google updates. Japan could be one of a number of emerging markets where growth is a real and serious opportunity. For these affiliates, looking at markets where ranking growth is possible due to the size of the opportunity and audience along with Google being less equipped to ‘police’ time-served SEO methodologies could be key to profit.

Overview of Japan’s gambling market

Japan’s gambling market does appear lucrative and the prevalence of traditional forms of gambling like pachinko are highly visible, signalling perhaps the future potential of online forms.

In terms of igaming, the trend does seem towards clearer legislation with the possible issuance of gambling licences for integrated resorts and the attractive tax take.

Japan’s gambling market does appear lucrative and the prevalence of traditional forms of gambling like pachinko are highly visible, signalling perhaps the future potential of online forms

At present it’s not <explicitly> legal for Japanese companies to run online casinos or betting sites aside from online betting on horse races, bicycle races, motorcycle races and motorboat races operated and self-regulated by the Japanese government or municipal bodies.

However, there’s no law stopping residents from gambling on foreign sites, which creates a situation where the government cracks down on the supply side (companies) but not the demand side (players) – with implications for marketing and SEO.

Robust gambling licences were initially predicted for 2020 but were waylaid due to the pandemic. Pretty soon, though, things will move at a greater pace with land-based casinos entering into Japan’s market by 2025.

This regulatory evolution, slow as it is, will almost certainly contribute to demand for online channels, and the normalisation of types of gambling that are a common feature elsewhere in the world.

With this in mind, it would be of no surprise if home-grown and international affiliates started to become more overt in their marketing strategies, laying the groundwork for further regulation not unlike what we’ve seen from ‘advisory’ and ‘informational’ affiliate sites in jurisdictions like the US, Brazil and Canada.

While a slow legislative process is a significant barrier to the most substantial opportunities, where there’s demand for info, there are SEO gains to be made.

The role of SEO

As with any market, leveraging SEO strategies tailored to the local linguistic and cultural context is crucial to gaining traction in the market.

In this regard the standard starting point is pretty familiar to seasoned affiliates, from conducting opportunity-seeking keyword research to implementing on-page optimisation techniques, there are a number of methods that don’t differ in Japan.

In terms of off-site SEO, be it in terms of link building or creative digital PR (e.g. link-earning) this is where the struggles for affiliates can lie.

Adding in the physical and cultural distance that comes from being an international brand trying to develop an SEO footprint in Japan, there’s even more potential for closed doors and declined proposals

With the ‘grey’ status of gambling, sites may be unwilling to link, perhaps under the impression that gambling is more scrutinised or ‘tackled’ by the authorities than it actually is. Likewise, PR campaigns can be of limited reach where journalists are unsure of the legal status and any attempt to ‘persuade’ can put them on the defensive.

Adding in the physical and cultural distance that comes from being an international brand trying to develop an SEO footprint in Japan, there’s even more potential for closed doors and declined proposals.

One way to break down some of these off-site obstacles is through over-investment in the onsite experience and brand.

Content strategy for Japanese audiences

Showing affinity for consumer preferences and providing clarity with non-promotional, straightforward content can help build trust with potential bettors, but also local publishers, influencers and site owners who are key to off-site success.

Part of this for some will be translation and localisation – an area my ICS-translate colleagues can confirm is unambiguously on the rise – but also the creation of native language content with local writers and authors.

While English terms such as ‘online casino’ and ‘casino’ make up about 13,000 searches per month the overwhelming majority of players expect to be able to find native Japanese content

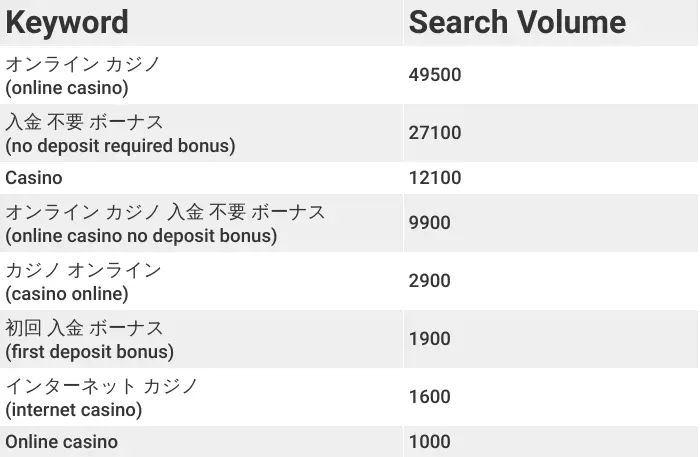

This can be demonstrated by surveying a snapshot of the keyword rankings Japan-facing gambling sites currently target through their content.

While English terms such as ‘online casino’ and ‘casino’ make up about 13,000 searches per month the overwhelming majority of players expect to be able to find native Japanese content.

For some affiliates, and certainly many operators, this will be a step too far based on their current understanding of the market but for those who commit to the opportunity, significant gains are possible.

The temptation for many of course is to go down the AI route but spinning up undifferentiated content on such a niche and developing industry is both likely to result in thin content of limited impact and, potentially, incorrect information.

For those with organic acquisition in mind, it’s not enough just to set a strategy. Having content that maps to the strategy and responds to how local users search will help you both sleep easy at night and avoid wasted time that only alienates potential bettors.

In creating this content it’s not just about an approximation of half-understood search trends but the opportunity to draw upon relevant themes, imagery, and tropes that signal to readers that you ‘get it’.

This in turn may open up off-site and link acquisition opportunities as the native affinity for igaming in the Japanese context will be clear and could potentially even help partners understand for themselves that reputable brands can operate within the current restrictions without controversy or risk to local customers.

For some betting affiliates, this focus on transparency, accuracy, and authenticity in content creation will be a new step but for emerging markets like Japan, this feels like the foundation for longer-term success.

The potential of AI and underlying tech

With this suggested focus on ‘real’, non-fake grassroots content aimed at Japanese audiences it may be that AI can provide a supporting role in making life easier elsewhere.

For example, when growing traffic, the battle isn’t over once a user visits the site – a profitable click or FTD is key to making the effort worthwhile so there is scope to use AI to further refine personalisation, interpretation of traffic trends and, more generally, for better choices to be made when it comes to platform technology.

This is particularly important given more visual norms in Japan compared to European or North American site experience and (of course) how information is best structured.

With "yokogaki" (横書き) writing, many forms of digital content in Japan use horizontal writing, with text flowing from left to right as in English.

Coupled with horizontal layouts in line with international standards for web design, this may simplify UX and platform decisions for affiliates but it’s worth noting that many sites at least provide the option for visitors to switch between horizontal and vertical writing views.

With this in mind, selecting the right platform, considering the visual design and both how users and search engine crawlers navigate to, understand and evaluate affiliate sites is key.

Testing and refinement, with the support of AI to trial variations in experience and, to a very limited extent, phraseology could be one other area to achieve an edge.

Future outlook

As Japan’s igaming market continues to evolve, affiliates must adapt to regulatory changes and emergent competition, but also prioritise effectively to provide a helpful and trustworthy experience that deserves to be ranked and linked to.